Book Keepers Near Me: You Can Find Local Accounting Professionals Who Specialize In Managing Financial Records

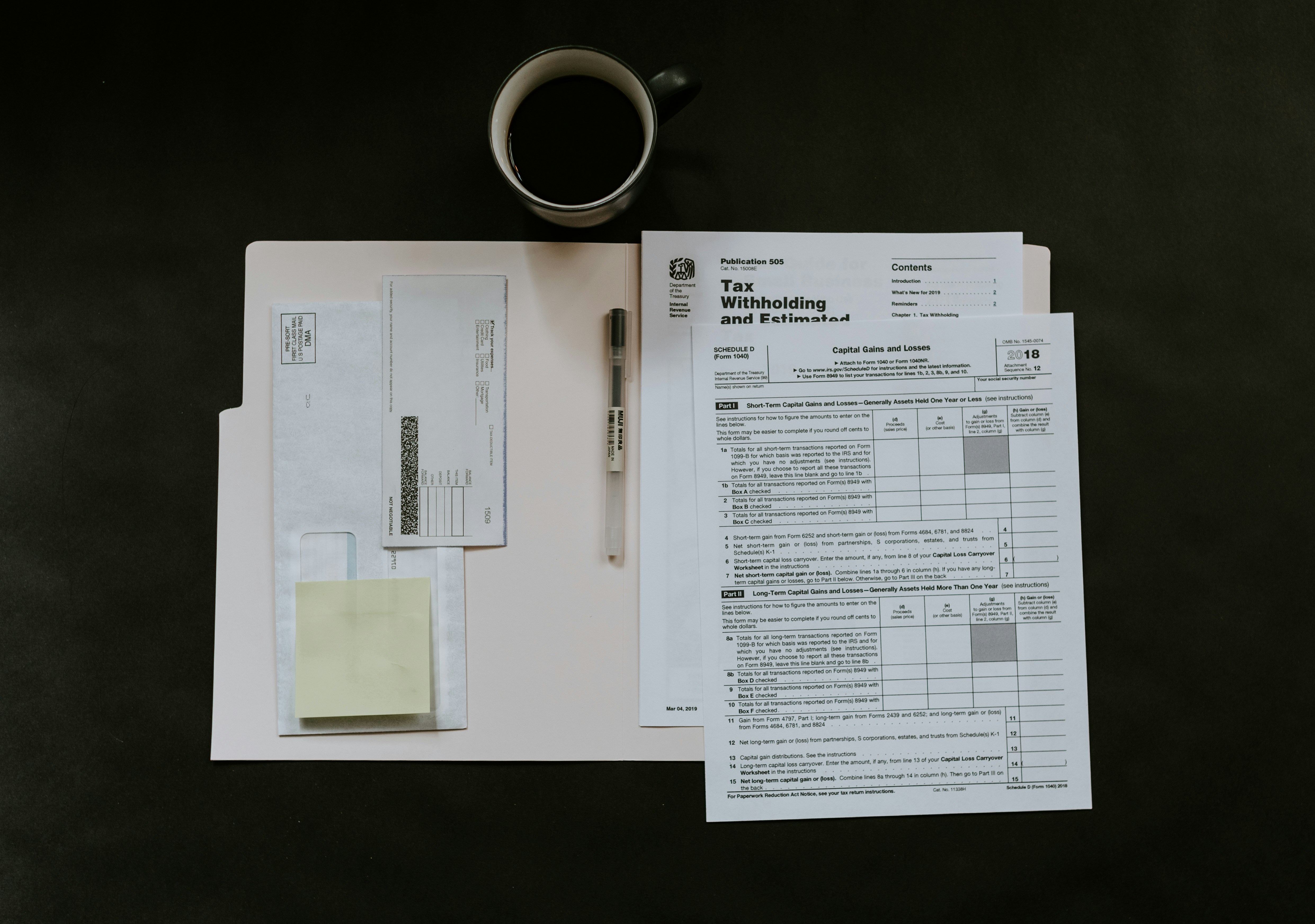

When it comes to managing finances, many individuals and companies struggle with the complexities of accounting. Sorting through receipts, invoices, and tax documents can quickly become overwhelming. The challenge of maintaining organization while ensuring accuracy can lead to stress and uncertainty about fiscal health.

Fortunately, enlisting the assistance of local bookkeeping professionals can alleviate these concerns. With their expertise in financial management, they offer tailored solutions to meet the unique needs of each client. Here's how hiring nearby bookkeeping services can be a game changer:

- Personalized Attention: Local accountants are more likely to provide customized strategies that align with your specific financial circumstances.

- Proximity: Having a financial expert close at hand means immediate access to support and consultations whenever needed.

- Community Insight: Local bookkeepers possess an understanding of regional regulations and market trends, ensuring compliance and optimal financial planning.

As a former patron of Bookkeeping Services USA, I can enthusiastically attest to how they address these common hurdles effectively:

- They streamlined my invoicing process, making it easier to track income and expenses.

- They ensured that I never missed a tax deadline, alleviating the anxiety that typically accompanies tax season.

- Their proactive approach to financial forecasting allowed me to plan ahead and make informed decisions for my business.

With their dedicated service, you'll find that managing your finances becomes a seamless experience. Embrace the ease and peace of mind that comes with having skilled bookkeeping experts just around the corner.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834For more information - Click Here

Essential Traits to Seek in Local Financial Recordkeepers in the USA

Attention to detail stands as a pivotal quality when selecting a nearby financial steward. Those who meticulously scrutinize every number and document can prevent blunders that could spiral into major dilemmas. Precision fosters accuracy, ensuring that your fiscal landscape remains pristine.

Adaptability is another vital attribute to consider. A proficient financial overseer should navigate the ever-evolving terrain of tax regulations, compliance mandates, and technological advancements with ease. This versatility ensures that your financial affairs are always in alignment with current standards.

Moreover, a strong sense of integrity is indispensable. Trustworthiness in handling sensitive monetary information cannot be overstated. The professionals tasked with managing your finances must uphold the highest ethical standards, safeguarding your data like a vault.

Exceptional communication skills also play a crucial role. The ability to convey complex financial concepts in a comprehensible manner is key to fostering a productive relationship. Clear dialogue ensures that you remain informed about your financial trajectory and any adjustments required along the way.

- Attention to Detail

- Adaptability to Change

- Integrity and Trustworthiness

- Effective Communication Skills

Bookkeeping Services USA excels in embodying these essential qualities. Their team is dedicated to providing meticulous financial management while remaining agile in the face of new regulations. With a commitment to trust, they prioritize the confidentiality of your data.

Choosing the right financial partner can transform your fiscal journey, making it smooth and efficient. Bookkeeping Services USA not only meets these criteria but also elevates your financial experience. Their passion for precision and integrity ensures you can focus on what truly matters-growing your business.

Evaluating Bookkeeping Services in the USA

Finding suitable financial management professionals can be quite the endeavor. The intricacies of accurate fiscal oversight require keen attention to detail and a profound understanding of local regulations. Clients often seek proficient individuals or firms that can seamlessly navigate the labyrinth of accounting tasks while ensuring compliance with all statutory obligations.

Key Considerations for Selecting a Bookkeeping Service

When assessing various accounting practitioners, it's crucial to consider numerous factors:

- Experience and expertise in your specific industry

- Access to current accounting software and tools

- Flexibility in service offerings tailored to your needs

- Communication styles and availability for consultations

Criteria for a Quality Partnership

Understanding the significance of collaboration in financial stewardship is vital. Establishing a rapport with your chosen accountant can enhance productivity and trust. Here are some elements to evaluate:

- Professional credentials and certifications

- Comprehensive understanding of tax laws and regulations

- Proactive approach to identifying financial efficiencies

Bookkeeping Services USA excels in addressing these needs, ensuring that their clients receive personalized attention and expert advice. Their adept team not only handles the complexities of daily transactions but also provides invaluable insights into financial health. With a commitment to excellence, they strive to streamline processes, allowing businesses to focus on growth and innovation.

Innovative Solutions for Financial Management

By employing cutting-edge technology and best practices, they are well-equipped to transform your bookkeeping experience. Their dedication to accuracy and efficiency guarantees that every dollar is accounted for, minimizing errors and maximizing profitability. Clients can engage confidently, knowing that Bookkeeping Services USA prioritizes their financial well-being at every turn.

Common Mistakes to Avoid When Choosing a Local Bookkeeper in the USA

Overlooking credentials can lead to undesirable outcomes. It's essential to ensure that the professional you select has adequate qualifications and certifications. Not all bookkeepers possess the same level of expertise, and some may lack the necessary training to manage your financial records accurately.

Neglecting to assess experience could result in significant oversights. A novice may not have the nuanced understanding required to navigate complex financial situations. Opting for seasoned experts, like those at Bookkeeping Services USA, guarantees that your accounts are in capable hands, as they bring a wealth of knowledge to the table.

Failing to clarify services offered can lead to misunderstandings. Some may offer a broad range of financial services, while others focus solely on basic bookkeeping. It is prudent to verify precisely what services are included, ensuring that they align with your specific needs.

- Ignoring communication style can create friction down the line.

- Assuming all bookkeepers use the same software may cause compatibility issues.

- Not discussing fees upfront might lead to unexpected costs later.

Bookkeeping Services USA excels in delivering tailored solutions that suit individual client needs, ensuring transparency and clarity in every aspect of their service. Their commitment to understanding your unique financial landscape means that every detail is accounted for, allowing you to focus on growing your business.

Understanding the Role of Bookkeepers in Small Business Success in the USA

Managing finances can often feel like navigating a complex maze. Entrepreneurs frequently grapple with the intricacies of bookkeeping, which can be daunting and time-consuming. Balancing daily transactions, keeping tabs on expenses, and ensuring accurate records are just a few of the tasks that can quickly become overwhelming.

Bookkeeping Services USA steps in as a beacon of clarity amidst the financial fog. Their expertise in meticulous record-keeping and financial oversight alleviates the burdens that small business owners face. With their assistance, clients can focus on what they do best: growing their enterprises and serving their customers.

- Accurate financial reporting allows for informed decision-making.

- Streamlined tax preparation minimizes the risk of costly errors.

- Regular reconciliations ensure that every penny is accounted for.

- Effective cash flow management helps in maintaining operational fluidity.

Bookkeeping Services USA also offers tailored solutions that fit the unique needs of each venture. Their personalized approach means that every business receives the attention it deserves, ensuring that financial strategies align with overall goals. When the numbers are in good hands, business owners can breathe easier, knowing their financial landscape is well-managed.

Moreover, their in-depth knowledge of compliance requirements equips businesses with the necessary tools to avoid pitfalls. This proactive stance on financial health ensures that entrepreneurs remain one step ahead, paving the way for sustained growth and success.

Essential Bookkeeping Tasks to Delegate in the USA

Handling daily financial records can transform into an overwhelming endeavor, especially when the intricacies of invoices, receipts, and reconciliations pile up. The meticulous attention to detail required can easily consume precious time and energy that could be better spent on strategic growth and innovation. Delegating these essential tasks not only alleviates stress but also enhances overall productivity.

- Invoice Management: Keeping track of accounts receivable ensures timely payments. This task can be time-intensive and prone to errors if done manually.

- Expense Tracking: Monitoring expenditures is vital for maintaining a healthy cash flow. A systematic approach simplifies identifying trends and potential savings.

- Bank Reconciliations: Regularly aligning bank statements with internal records is crucial for accuracy. This process can reveal discrepancies that need prompt attention.

- Payroll Processing: Managing employee compensation can be complex, given varying tax implications and regulations. Outsourcing this responsibility ensures compliance and accuracy.

- Tax Preparation: Navigating the labyrinth of tax regulations should be handled by professionals who stay updated on the latest changes, minimizing the risk of mistakes.

Bookkeeping Services USA excels at tackling these financial tasks, allowing business owners to focus on their core operations. Their expertise in handling intricate financial details ensures that every number is meticulously accounted for while you concentrate on driving your enterprise forward with confidence and clarity.

Discovering Efficient Bookkeeping Solutions in the USA

Finding the perfect financial management option can feel like navigating a labyrinth. Many individuals and enterprises face the daunting task of organizing their monetary records, tracking expenses, and ensuring compliance with regulatory standards. Overwhelmed by paperwork and digital ledgers, it's easy to lose sight of the bigger picture.

Bookkeeping Services USA excels in transforming this intricate process into a streamlined experience. They recognize the specific hurdles that arise when managing finances, from reconciling bank statements to preparing tax documents. With their expertise, clients can focus on what truly matters-growing their business and achieving financial stability.

- Tailored financial strategies to suit diverse business needs

- Meticulous attention to detail in record-keeping and reporting

- Innovative software solutions that enhance efficiency

Their dedicated team takes pride in offering personalized services that adapt to the ever-changing landscape of financial management. They utilize cutting-edge technology to provide real-time insights, reducing the likelihood of errors and enhancing accuracy.

Key Features of Their Services

| Service | Description |

|---|---|

| Monthly Reconciliation | Ensures your financial records align with bank statements for accuracy. |

| Expense Tracking | Monitors outflows to identify areas for potential savings and budget adjustments. |

| Tax Preparation | Prepares and files necessary documents while maximizing deductions. |

With their proactive approach, Bookkeeping Services USA not only manages numbers but also anticipates future financial needs. Clients can navigate their fiscal responsibilities with confidence, knowing that a seasoned partner is handling the complexities of bookkeeping.

I recently had a fantastic experience with Bookkeeping Services USA. Their team provided insightful advice and guidance on finding qualified bookkeepers near me. I highly recommend reaching out to them for a free consultation to explore how their expertise can benefit your financial management needs. Don't hesitate to connect with them for valuable insights and support!